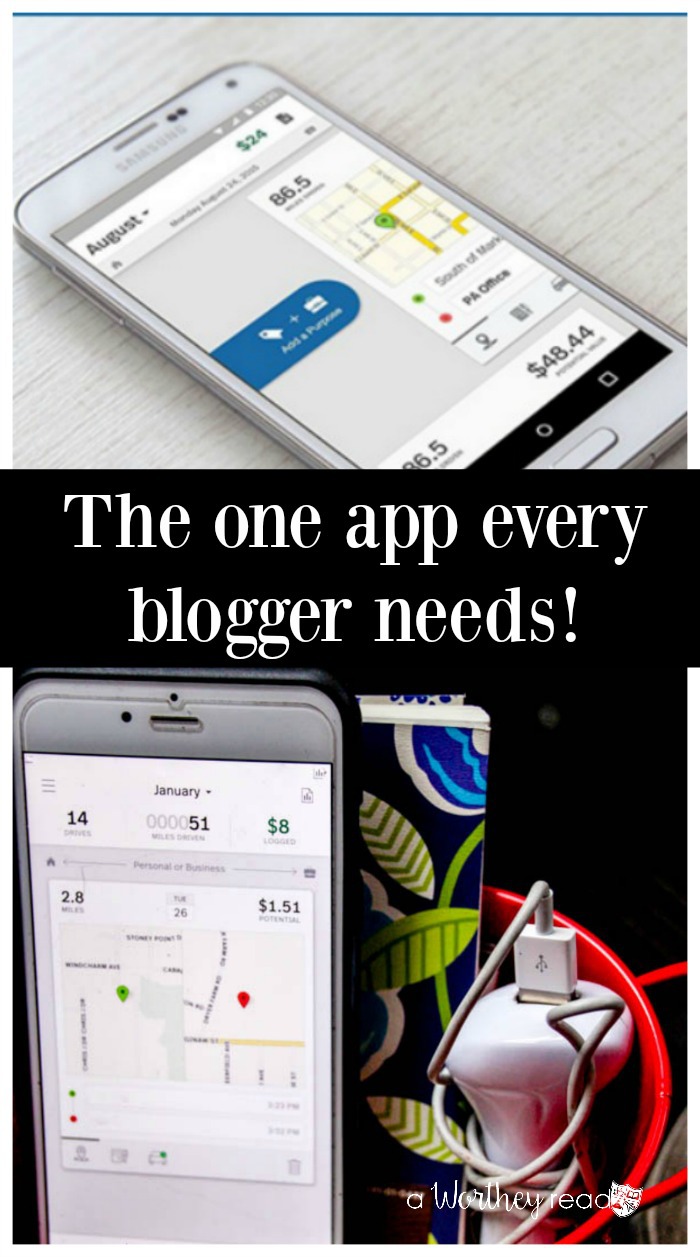

Own a business or a blogger? Here’s the best Mileage Tracking App you should be using for your business!

This post is sponsored by Mile IQ, but all opinions are my own.

Why You Should Use A Mileage Tracking App

It’s timely that I am talking to you guys today about mileage, using an automatic mileage tracking app, and the importance of tracking your miles with tax season just getting started.

I’m self-employed, and I’m beginning to take deep breaths around this time of the year.

Why?

Because I have to wade through many receipts and papers to document my tax return.

I promise myself, “Next year, Tat, we will get this together!”

And every year (going into my third year of being self-employed), I face this dilemma.

When I first started blogging (I also own a frugal/deal blog), I ran to several stores looking for deals and blogging about those deals.

Thank goodness for good gas mileage. I can’t even tell you HOW many miles I racked up on my Sorento. AND thank goodness my stores were all within a few miles of each other.

However, it took forever when I sat down to do my taxes. I had to go back through each month, putting numbers together and trying to remember all of my trips. It’s always a nightmare, and I feel I could be putting my time to better use.

And trust me, I’ve tried to write them down in a notebook and even kept track of my gas and mileage with other apps, but I would forget to log the numbers in each time.

{dramatic pause}

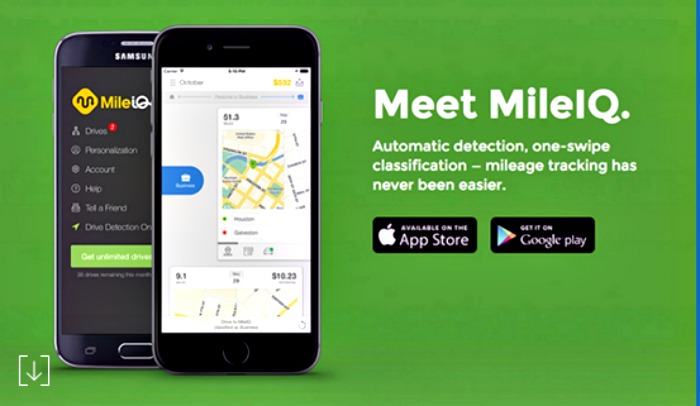

Then I discovered the MileIQ app. Initially, I read about this app several months ago through another blogger, Thrift Diving. I made a mental note to check it out.

Fast forward to today.

With the thoughts of working on tax returns soon, I decided this year would be the year of really being on-point with everything!

Including my business, so I downloaded the app. {be sure to allow the app access to your location}

Come to find out; this app is exactly what I need! As a Mom and businesswoman, I am constantly on the go.

During the school/football seasons, I live in my car. I can quickly rack up a ton of miles between school, practices, doctor’s appointments, errands, and business errands.

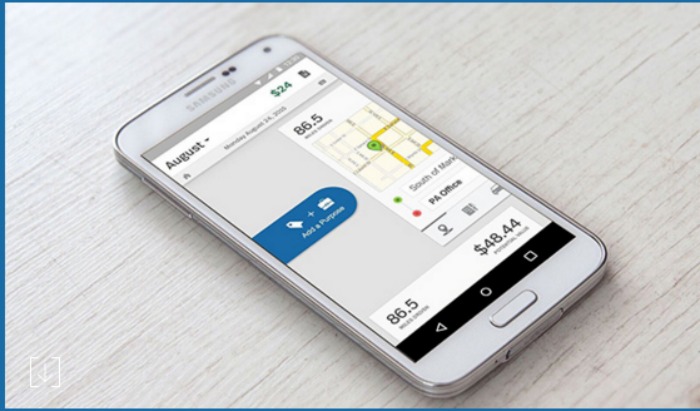

That being said, it’s challenging trying to decipher which miles are personal and which miles are for business. With the MileIQ app, I can easily track these miles.

You swipe to the left when you want to categorize your miles for personal reasons. And then swipe to the right when you want to put the miles in the business category (to the left, to the left).

So, I get in the car and drive to the store to get the necessary supplies for an upcoming blog post. I have to run to Meijer. They didn’t have what I needed, so I had to stop at other stores. With each trip, it automatically detected when the car was moving, so I didn’t have to worry about logging my miles. -Talk about making my trips smarter! #MakeTripsSmarter

After each mile related to business, it tells me how much money I have logged. This is the potential tax deduction I will receive on my tax return for accurately documenting my mileage.

The husband creates delicious recipes and beautiful cocktails on the blog, which requires several trips to the store. I’m not sure if you guys know this, but men don’t always plan well.

We fly back and forth to the store to get the missing ingredients when this happens.

Who would remember to document every mile with all of those trips? But those miles add up, and it’s money I’m leaving on the table if I am not recording them correctly.

Thank goodness, I can now call MileIQ a necessity for my business!

Here are the main reasons I like MileIQ and how it can benefit YOU.

- It works without you remembering to use it. With the automatic drive detection, it captures every mile you drive. The app will run in the background. They sold me with THIS option! Remember I mentioned that I had to log every mile with other apps, which I forgot to do? This reason alone is enough to say yes, sign me up for a MileIQ account!

- You can easily take the guesswork out of which miles are personal or for business (especially if you’re using your vehicle).

- Tax Deduction. We can claim the Home office deduction and the Mileage deduction on our taxes. This helps offset any taxes I may owe. Every cent counts and should be tracked! MileIQ adheres to the IRS rules and regulations each tax year (present rate: 2016 mileage rate).

- Cost. The first 40 drives are free. You pay $5.99 per month or $59.99 per year. And I am listing a coupon code to help you save 20%. And this cost is usually tax-deductible as a business expense and quickly pays for itself! Double bonus!

- Easy to use. You can quickly send the mileage logs to your email or your accountant’s email. Now, how easy and convenient is that??

Even if you are not self-employed, you still need to try this app. Do you run an Etsy, eBay, or another type of Internet business where you’re running to the post office to drop off orders or grab supplies?

Do you bake cakes out of your home and sell them? Do you freelance?

If you are using your vehicle for work, you need to keep track of your mileage. Unless you enjoy spending time remembering to write it all down with the old-fashioned pen and paper, you have nothing to lose by trying out MileIQ!

You can get 40 drives for FREE. If you want to upgrade and get the unlimited version, it’s just $5.99 per month (or $59.99 per year).

However, use coupon code SMARTTRIPS20 to save 20% OFF!

You can head over to their website to find more information about MileIQ.

You can also download the app on Itunes or Google Play.

If you opt to upgrade, follow these instructions to use code SMARTTRIPS20 to save 20% OFF!

I am a big fan of apps and using technology to make my life easier.

When I initially heard of this app, I didn’t consider the value and how it would save me time and money.

However, after using the MileIQ app, I am keeping it and will upgrade to an unlimited plan. I will quickly blow through 40 drives with all of the running around we do for the blogs and the boys.

What are your thoughts on this app? Have you heard of it before? Do you run your own business?

Get more information about MileIQ, and come back and leave me your feedback! What are some ways you organize your mileage?

Leave me a comment below. I would love to hear from you!

Serena @ Thrift Diving says

I love this app! Several months ago I found myself with my spreadsheet open and receipts scattered all over my desk, and wouldn’t you know I wasted a good hour or more trying to figure out where I had driven to! I decided I wouldn’t do that anymore. I like that MileIQ helps me do it automatically and I can email reports to myself!!

Robin (Masshole Mommy) says

We use an app to track our steps when we go to Disney. It’s cool to see how many miles we walk in a day there.

Heather lawrence says

We really need to get this app for my hubby.

We are self employed and this would be a more accurate way to track our mileage and get the best bang for our buck!

lisa says

Mileage tracker seems like a great app to keep track of your yearly mileage. This would be a lifesaver at tax time (right now)!

Jeanette says

That is a great idea! My hubby drives for work a lot and I would love to get some of that money back!

Liz Mays says

Ah, you’re so right. I probably waste a lot of gas going from store to store without a plan. This sounds like an awesome app.

Travel Blogger says

Great tip! I never realized how much I drove for work until I tracked my mileage. It is so important to track it for the potential tax deduction.

Liz Mays says

It’s definitely a good idea to start going for those deductions. They can make a big difference!

Miles L. says

The MileIQ app looks like a very useful application. I also want to know my car’s mileage and fuel efficiency.

OurFamilyWorld says

This is interesting. It’s good to know that there is now an app for this. I will check this out.

victoria says

That is a great app. My hubby was always driving out. I can track him now

Nathan G. says

I’ve been looking for a good mile tracking app rather than pen and paper. I’ll check this out!

Kelli @ 3 Boys and a Dog says

This is definitely a great tool to have if you are self employed! It’s amazing what technology has come with! A far cry from writing down the odometer at the beginning and end of each trip!

Sicorra@NotNowMomsBusy says

Love that app! Perfect for people that do a lot of business travel and want to keep track of their mileage for their taxes. We do very little travel for our business right now, but I would definitely use that if and when we start doing more.

Chubskulit Rose says

I would recommend this to my husband who drives everyday going to work. This app would sure save time during tax season.

Terri says

I have to keep up with everything for my small business as well and it can definitely be a pain if I don’t log as I go. This app is going to make tracking mileage a breeze for me!

Annemarie LeBlanc says

Great app to have! Tax season is approaching fast and we are all just about to go crazy with filing our forms. I this a mileage tracking app would be great to have this year, so we can go through tax season easily next year! Thanks for sharing this.

Jessica Simms says

This looks so helpful! I really need to use this app to help me keep better track of things.

Tracy @ Ascending Butterfly says

I don’t drive so I am not familiar with most of the driving apps but I can certainly how this would come in handy for my fellow entrepreneurs who do drive,

Cindy (Prime Beauty) says

I’m downloading this now–I always forget to write it down!

Christine - The Choosy Mommy says

Luckily I only have to travel once a month for work so the mileage is pretty easy to track, but a couple years ago I def. could’ve used this app! I will certainly share this with my traveling friends.

travel blogger says

We need to track our mileage. We drive so much for work. It would definitely be a great tax deduction.

Elizabeth O. says

What an awesome productivity app. It would sure help with all the things you need to keep track of. Thanks for sharing!

Adriana says

I am going to download this app now! How amazing – I need this!

Carmela Mempin says

I’m going to download this awesome app. 🙂 These is very useful to many. Thank you for sharing

Mommy Pehpot says

Good thing you discovered this app! Now it makes a lot easier for you 🙂

Ron Leyba says

What a great app to have. Will download and install this one soon.

jeni hawkins says

This sounds like a great app to have! Thank you for the post!

Patrice says

Sounds like a great app to have especially traveling for business. Great at helping me track milage sounds like a plan.

Stephanie of The TipToe Fairy says

This sounds awesome! I total my miles based on my receipts, but this sounds like such a much better way to do it.

Shannon Gurnee says

That sounds like a great app! I hadn’t thought about using a mileage tracking app. Thanks for sharing.

Rosey says

I can see myself forgetting to log miles too. This sounds great!

Lisa Rios says

I think it is great to have one such tracking app, so you know the mileage you use on your trips & for a month or so. I would love to try it out as we travel a lot all through the year.

Coralie says

I just downloaded it and can’t wait to start using it. This will help me so much.Thanks!

T Worthey says

Awesome! Let me know how you like it!

Melissa Bernardo says

I have never thought to use a mileage tracker app. For someone who does mystery shopping, this would come in handy.

Peachy @ The Peach Kitchen says

MileIQ seems like a great app to track mileage because it makes it easier! Will recommend this to friends.